Key Findings

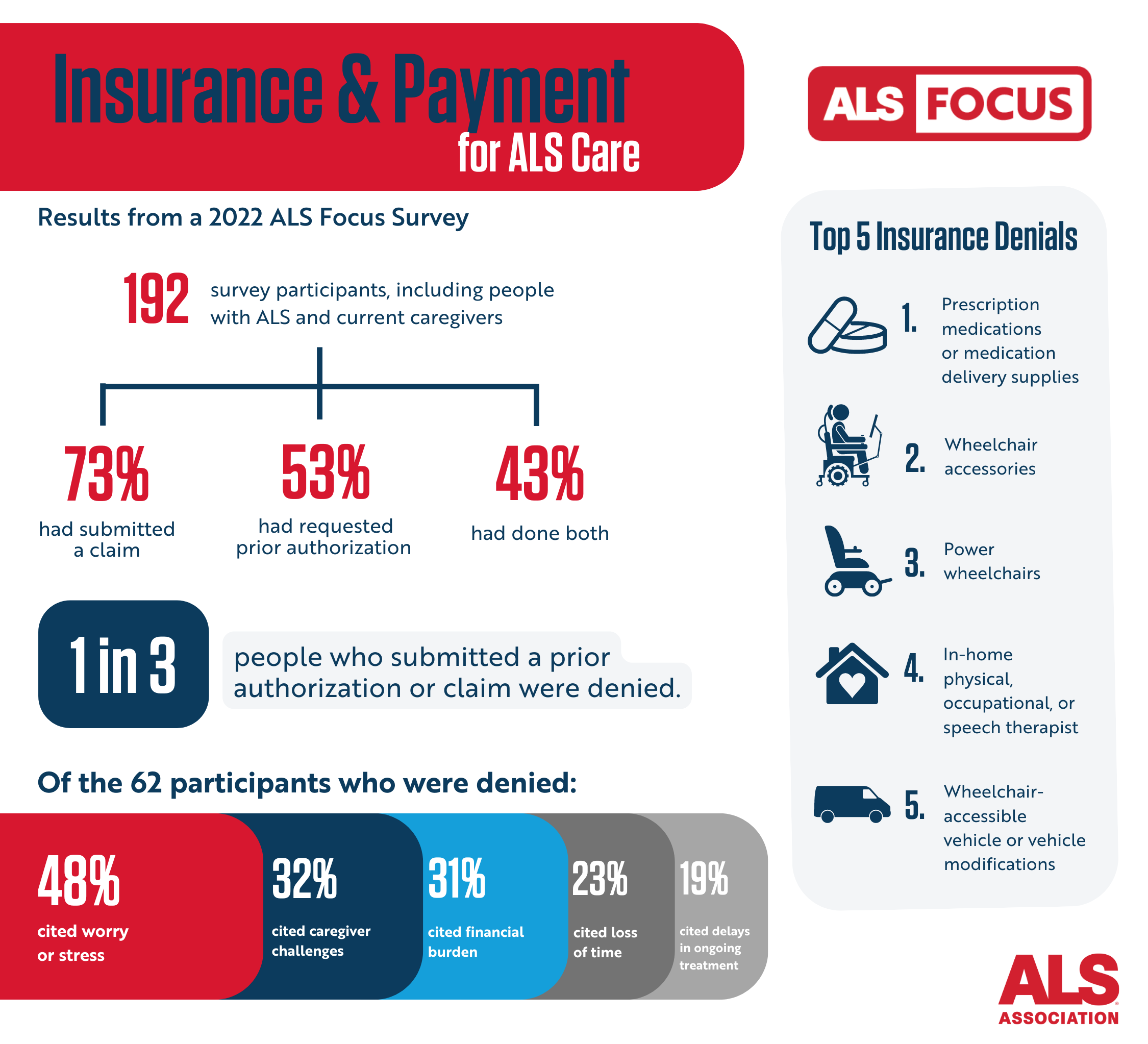

This survey showed that people with ALS and caregivers are accustomed to submitting claims and prior authorization requests to health care insurers, including Medicare, Medicaid, employer-sponsored plans, private insurers, and the Veterans Administration (VA). They also are familiar with insurance denials. Approximately one in three participants reported submitting at least one claim or prior authorization that had been denied. These denials were most often for medications, mobility equipment with necessary accessories, or in-home care services.

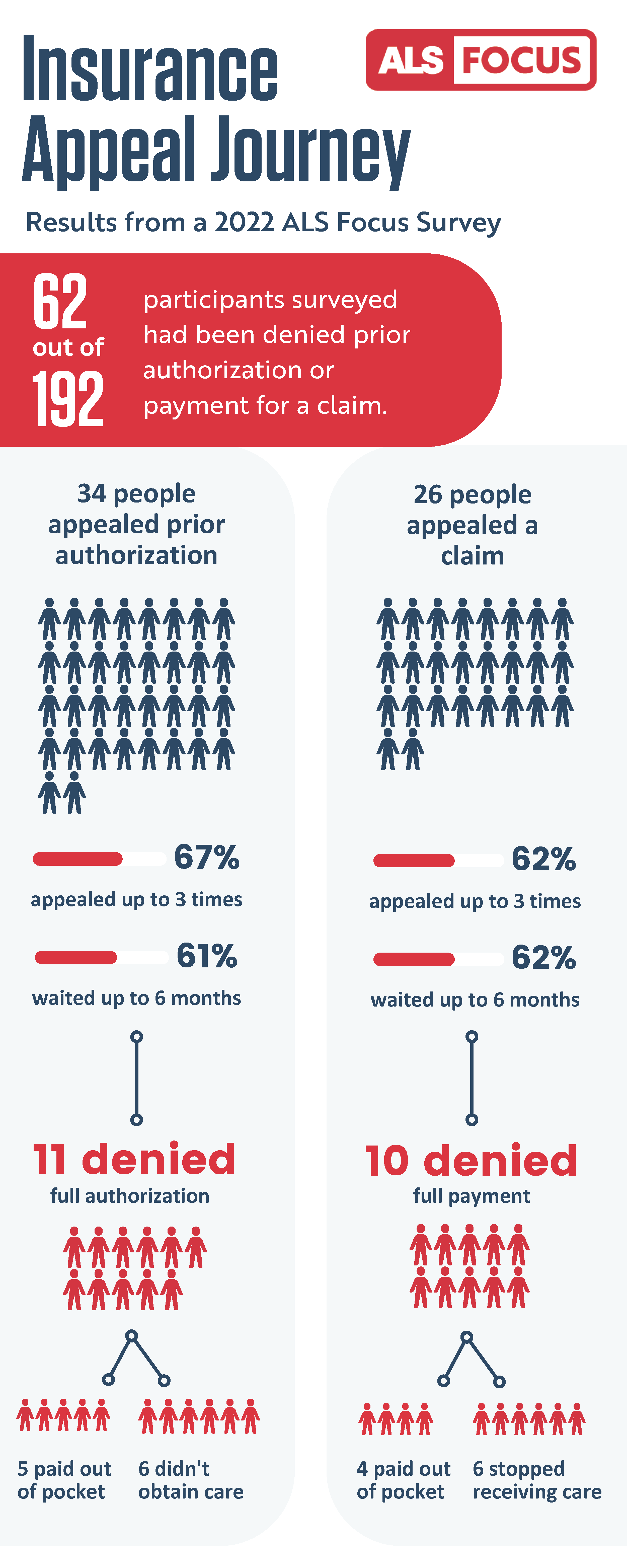

Although more participants had submitted claims than prior authorizations for ALS care, fewer appealed claims when they were denied. Participants also noted they often had to appeal up to three times and wait up to six months for a final resolution. Following the appeal process, roughly a third of prior authorizations and claims were still denied or only partially granted, leading some to pay out of pocket or not receive the care or service they needed.

The results of this survey also demonstrate the high burden that denials of essential ALS care place on people living with ALS. Many participants noted that jumping through the hoops of these processes, even if it eventually results in an approval, puts additional strain on individuals and families already dealing with so much. For many, spending months waiting for care, services, equipment, or therapies wastes time that is limited and precious. These cumbersome processes are not constrained to one specific insurance company or type of care but are part and parcel of living with ALS. More must be done to ensure that our community is receiving the timely care they need without the hassle.

Results Summary

Below we summarize the main results of this ALS Focus survey. All data collected from ALS Focus surveys are available online for free. Complete data from this survey will be publicly available in late 2023.

Insurance Coverage

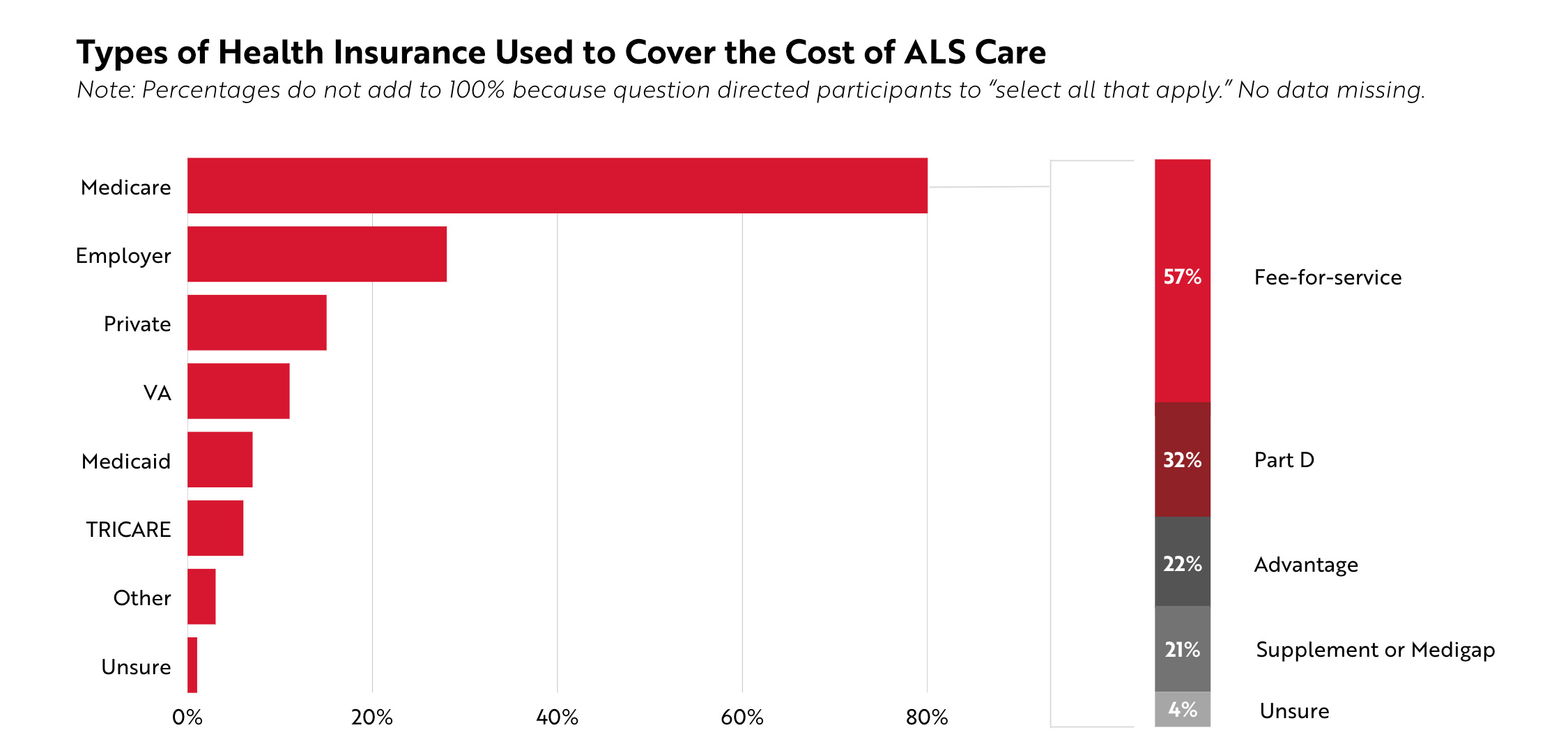

All people with ALS reflected in this survey had some type of health insurance coverage. Participants were asked to select all the health insurance or health coverage they or the person they care for currently use to cover the costs of treating ALS. The majority of participants (80%) reported using Medicare. About a quarter of participants (28%) used an employer-sponsored health insurance plan, 15% had a private insurance plan, and 11% received care through the VA. No participants selected Alaska Native, Indian Health Service, Tribal Health Services insurance, no coverage of any type, or prefer not to answer.

For the 154 participants who had Medicare, more than half (57%, n=109) indicated using a fee-for-service plan. Participants also utilized Medicare Part D (32%, n=61), Medicare Advantage (22%, n=43), and/or Medicare Supplement / Medigap (21%, n=41) plans to cover the cost of their care.

Prior Authorization and Claim Submissions

Submitting prior authorization requests and/or claims through insurance is a common experience among people living with ALS and their caregivers. A prior authorization was defined as a request to a person’s health insurance plan to pay for care, services, treatments, or equipment before receiving it. A claim was defined as a request to a person’s health insurance plan to pay for care, services, treatments, or equipment after receiving it.

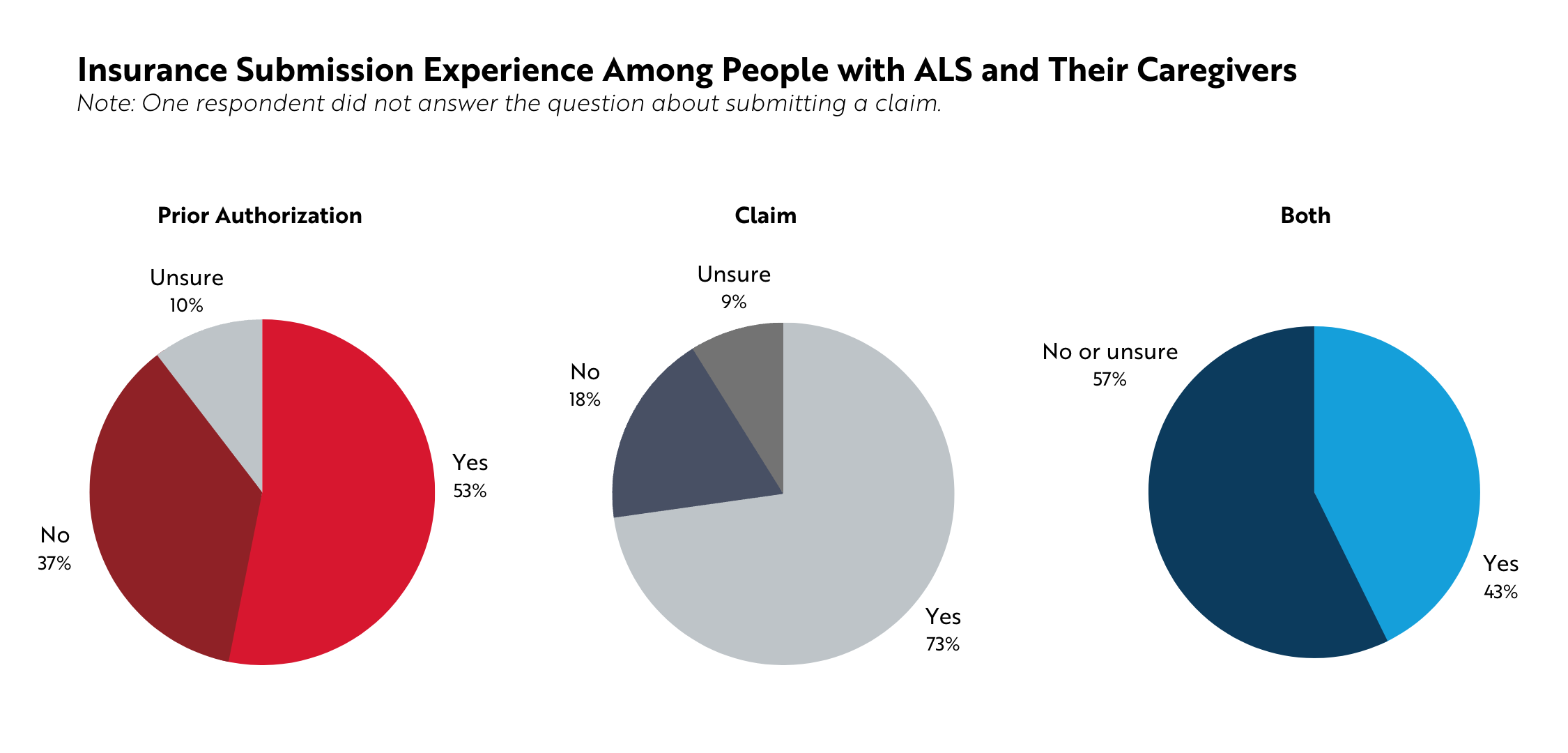

More than half of participants (53%, n=102) reported they had requested prior authorization for ALS care, either for themself or the person they cared for. The need to submit a prior authorization varied based on insurance type. More than half of people with employer-sponsored insurance (59%, n=32), Medicare (55%, n=84), and private insurance (52%, n=15) said they had submitted a prior authorization for ALS care.

Nearly three out of four participants (73%, n=139) reported submitting a claim for ALS care, either for themself or the person they cared for. As with prior authorizations, the need to submit a claim varied based on insurance type, with 86% of people with private insurance (n=25), 86% of those with Medicaid (n=12), and 76% of those with Medicare (n=116) responding that they had submitted a claim to their current insurer.

43% of people with ALS and current caregivers (n=82) had submitted both a prior authorization and a claim.

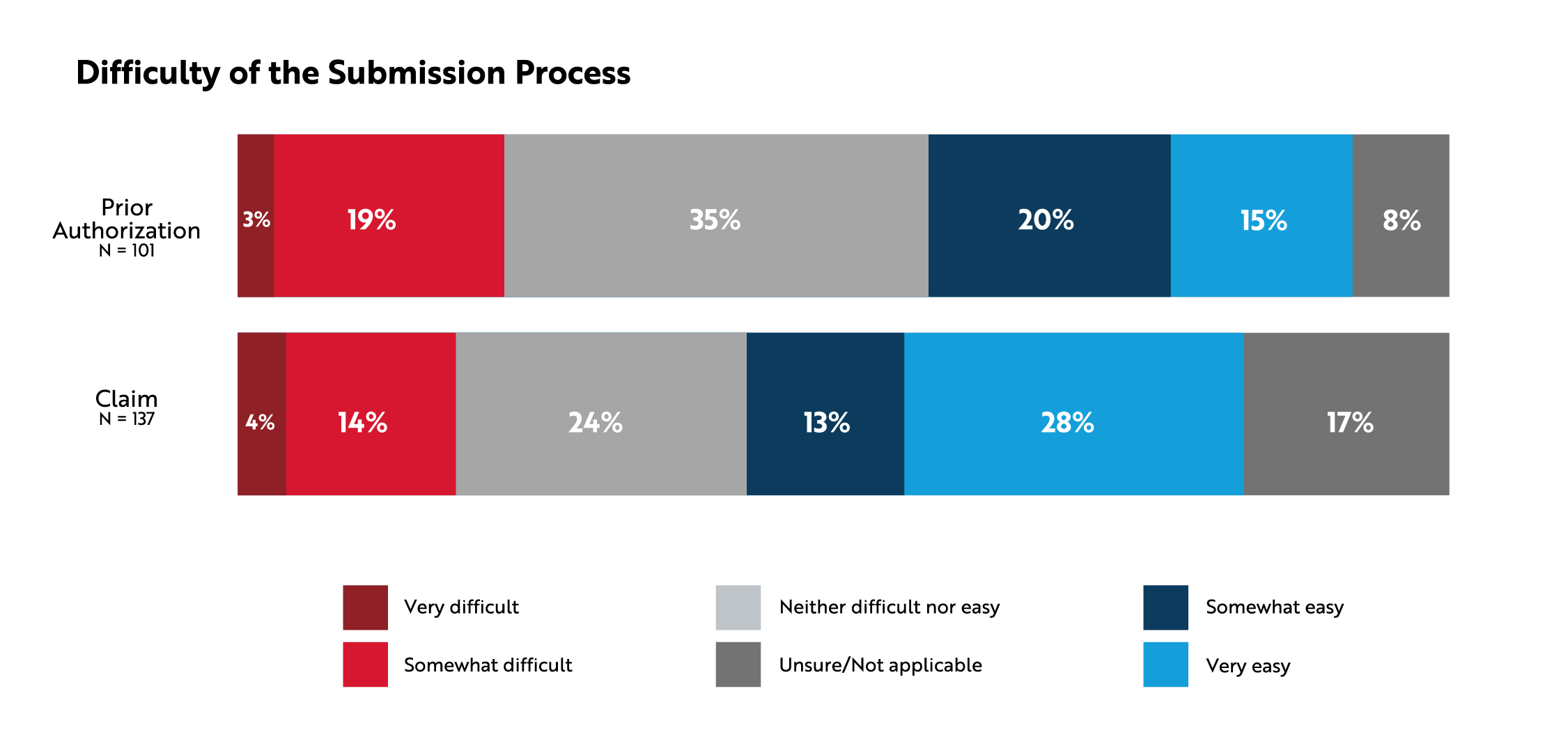

When asked about how easy or difficult the submission process was, more than a third of participants said it was either somewhat or very easy to submit a prior authorization or claim (35% and 41%, respectively). Approximately one in five described the process as somewhat or very difficult (22% and 18%, respectively).

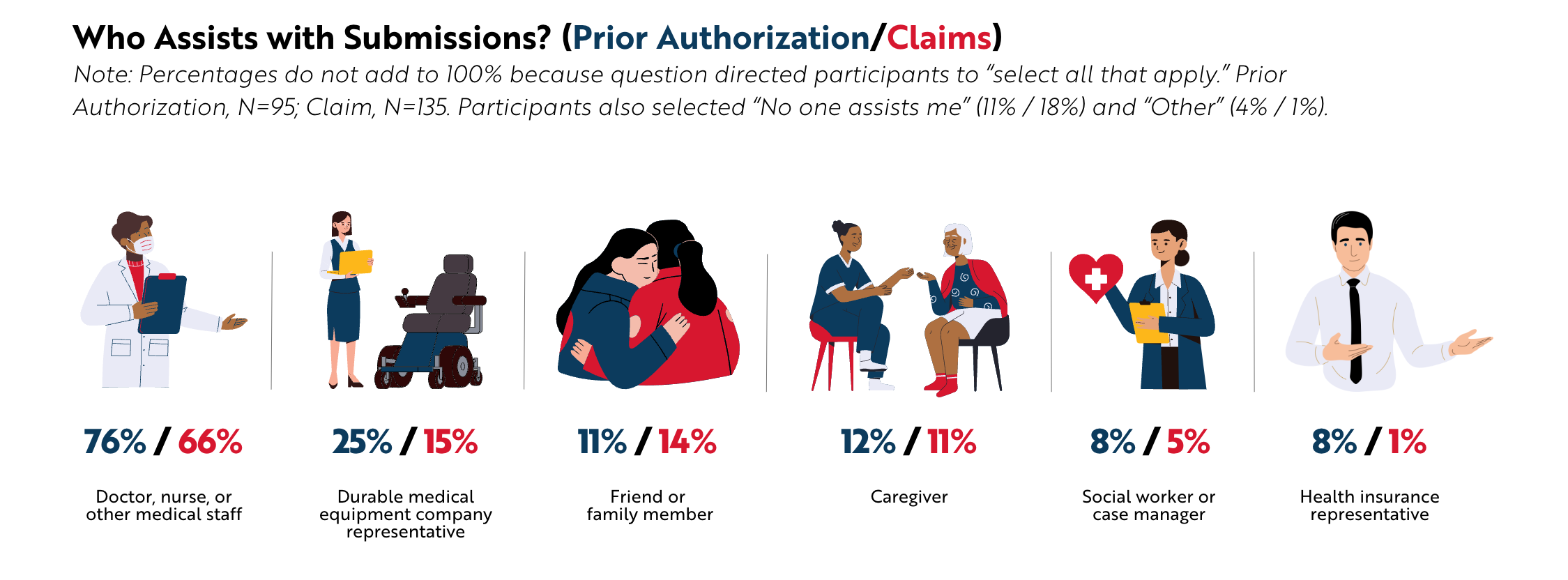

Participants indicated that they usually had help submitting prior authorizations and claims. Most often, they were assisted by nurses, doctors, or other medical staff members or a durable medical equipment company representative.

Prior Authorization or Claim Denial

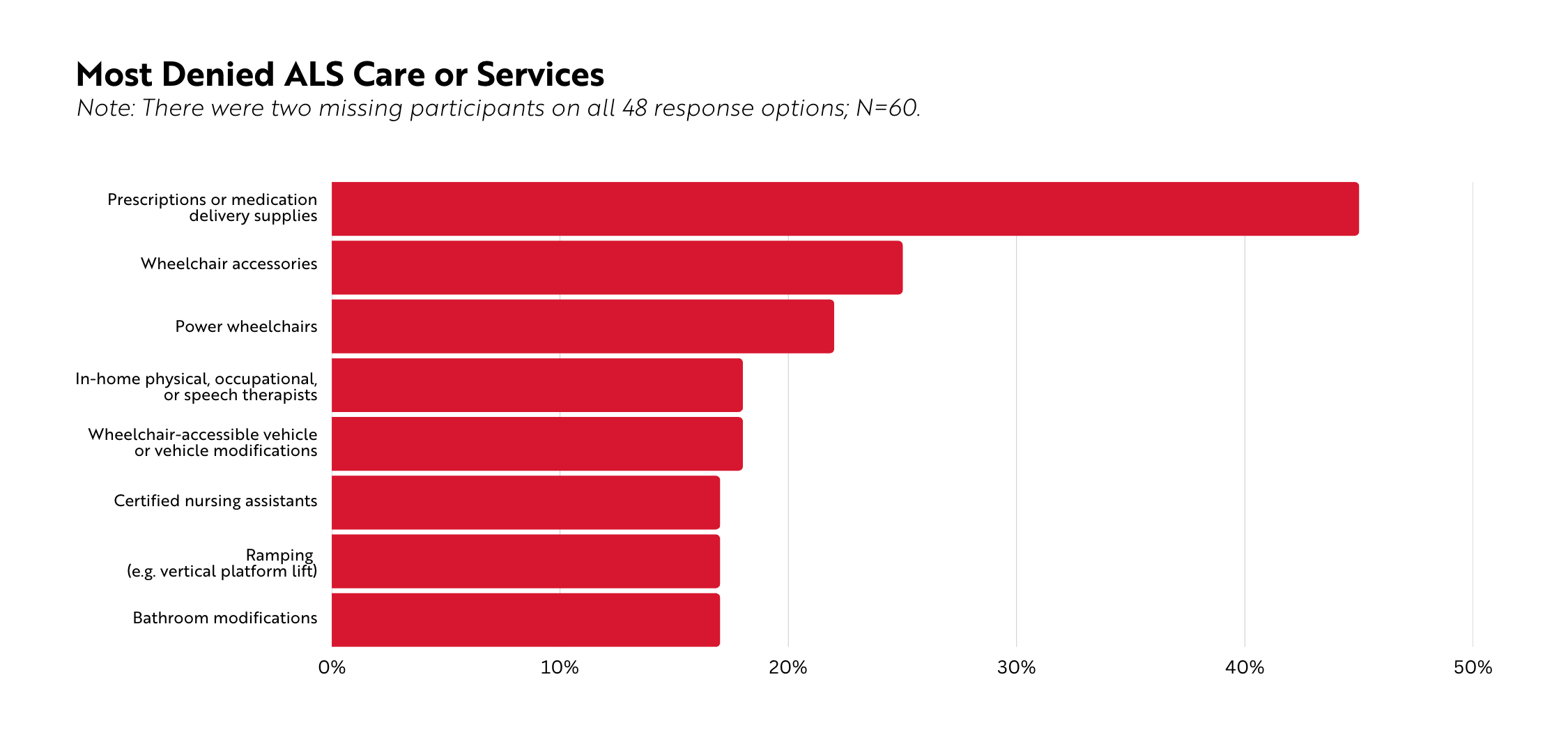

Denials of ALS care and services are not uncommon. Of participants who had submitted a prior authorization or a claim, approximately one in three had been denied (n=62). Issues with medication coverage were reported frequently (e.g., denials, appeals, out of pocket costs).

Nearly half of participants (47%, n=28) who had been denied indicated it was for mobility equipment with necessary accessories. In open-ended responses, many people mentioned being denied for power wheelchair enhancements and/or modifications (e.g., eye gaze, ability drive).

In-home care services – including care delivered by physical therapists, occupational therapists, speech therapists, and certified nursing assistants, among others – were the third most common denial, reported by 38% of participants (n=23). Several people mentioned the need to have financial support for full-time caregiving, not just for the well-being of the person with ALS but also to ensure the primary caregivers’ own health is not compromised.

The Impact of Denials

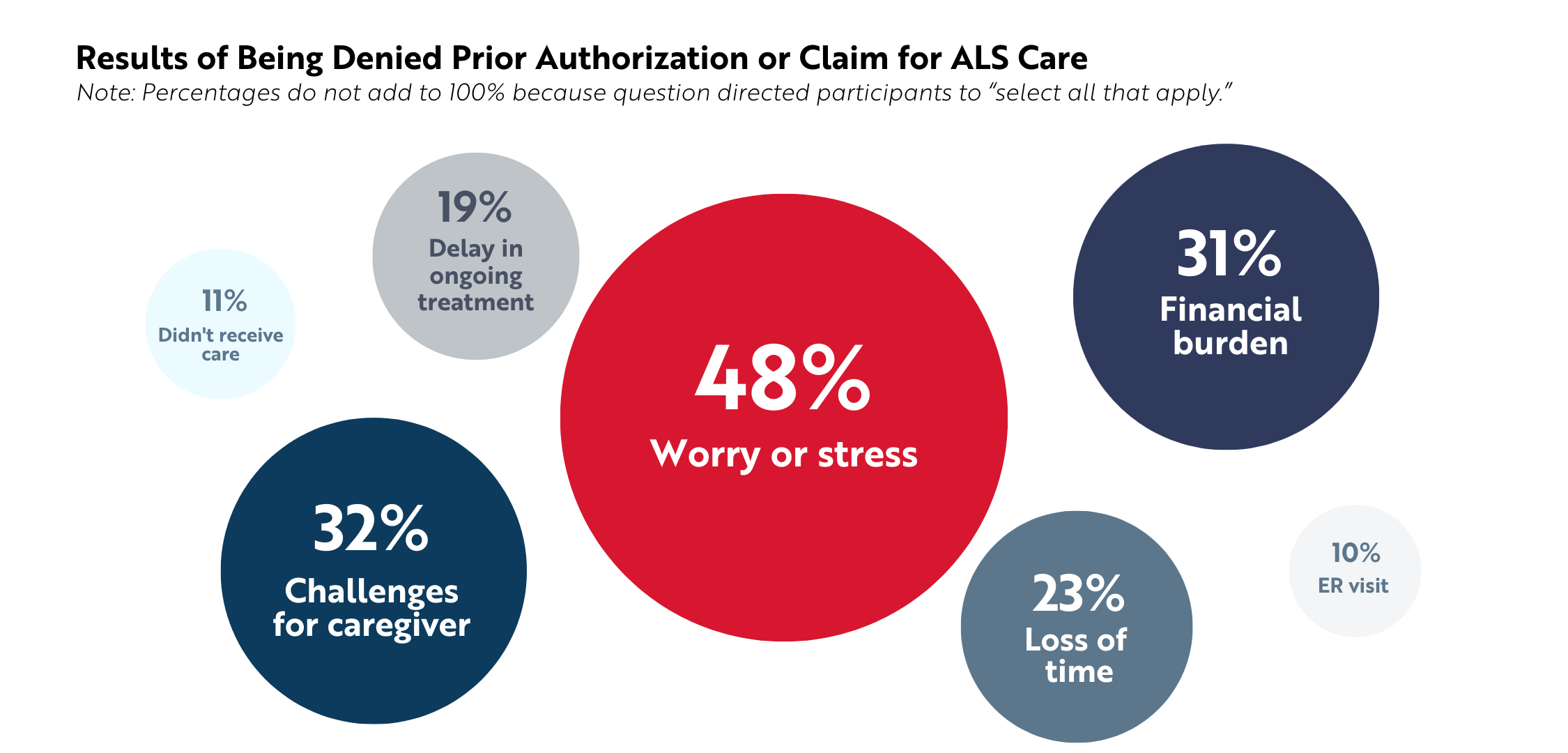

Insurance denials take a toll on the well-being of people with ALS and their caregivers. Of the 62 participants who were denied prior authorization or payment for a claim, 48% reported they experienced worry or stress (n=30). Denials also caused caregiver challenges (32%, n=20), financial burden (31%, n=19), loss of time (23%, n=14), and delays in ongoing treatment (19%, n=12).

Appeal Process and Burden

Following a denial, 67% of those denied prior authorization and 47% of those denied a claim appealed the insurer’s decision (n=34 and n=26, respectively). According to participants, they had to appeal up to three times and wait up to 6 months for a resolution. After completing this process, people received at least a partial denial of payment about a third of the time. For those denied full authorization or payment, they either had to pay out of pocket or not obtain / discontinue the care. This included medications, specialized beds, power wheelchair modifications, in-home care, genetic testing, and other supplies needed for daily living with ALS.

Qualitative Findings

Five distinct themes emerged from 102 responses to the final open-ended survey question, which asked: “What else would you like us to know about your experiences with health insurance plans related to paying for care, services, treatments, equipment, or supplies for ALS?”

Jumping through Hoops

After appealing, people are often able to access what they need, but the process of appealing is burdensome, expends energy, and wastes precious time. As one person stated, “We have to exhaust so much time and energy calling, following up, asking questions, it’s overwhelming the way it is.”

Needing to Be Resourceful

Some people find ways to navigate or circumvent the system through resources like durable medical equipment companies or ALS organizations. Others haven’t found such workarounds, potentially reinforcing ongoing health disparities and access issues.

Worrying about Coverage

Even when their current needs were met, anticipating future needs and changes (e.g., insurance transitions, new treatments) evoked anxiety and fear in both people with ALS and caregivers.

Complaints about Medicare

People articulated frustration with denials and appeals through Medicare, which insures a large number of people with ALS. One person pointed out systematic barriers when trying to appeal: “Medicare appeal process is too rigid … No electronic process I can use on my eye gaze computer.”

Feeling Misunderstood

Insurance companies lack familiarity with or understanding of ALS and what people with the disease need. One person with ALS remarked they felt “frustrated that each time a new prescription for a medication is sent, [I] have to go through the same process of appeals. Medicine denied because it doesn’t show signs of improvement when it is clear the drug is to slow the progression.”

Survey Methods

This study, as part of ALS Focus, has an exemption determination from the Western Institutional Review Board. The results presented here are not intended to represent the full population of people with ALS or ALS caregivers in the United States. Instead, these results reflect the needs and experiences of those who participated in the survey.

In this analysis, missing cases reflect when participants were not shown questions due to predetermined skip patterns or when participants were eligible to respond but did not. Thus, percentages are based on non-missing values. For many questions, participants had the option to select “Prefer not to answer,” “Not applicable,” or “Do not know,” and these responses were retained when calculating percentages.

Limitations

Other ALS Focus surveys, which were open for two months or more, recruited nearly 400 or more participants. In comparison, this survey recruited fewer participants because it was open for only three weeks (November 28 – December 16, 2022). A total of 212 people were included in the full survey sample; however, 20 individuals were excluded from the analysis due to duplicate or incomplete responses. Moreover, within the small sample, not all participants responded to every question due to predetermined skip patterns. Questions about insurance denials were asked only of those who recalled submitting prior authorizations or claims, and questions about appeals were asked only of those who reported being denied. Therefore, the denials and appeals analyses relied on small counts, making definitive conclusions based on subsequent percentages impossible.

Opening this survey again for a longer timeframe to increase the sample size and reliability of percentages is warranted to gather even more evidence of the importance of insurance providers covering ALS care early and often.