General Health Insurance Questions

- Is there an annual deductible?

- Is there an annual individual/individual + family out-of-pocket expense limit or maximum? If I meet my limit, does my coverage increase and to what extent? Is there an annual or lifetime maximum?

- Do I need to complete any claim forms?

- Am I subject to pre-existing condition regulations?

- For what services do I need pre-authorization?

- What does insurance cover/not cover that a person with ALS needs?

Durable Medical Equipment (DME) Questions

- Does my plan cover DME? What about ventilator and noninvasive ventilator coverage; are they under respiratory equipment or DME?

- What is my coverage for a complex power wheelchair and/or speech generating device?

- What is the percentage of my coverage?

- Is there a preferred provider I must see?

- Is pre-authorization or a medical review required?

- Do I have access to loaner equipment if there is a delay in having my DME serviced?

- Do I have the ability to fix or find a DME servicer or is coverage restricted to preferred servicers?

Prescription Questions

- Does my plan cover prescription drugs? What are the terms of this coverage, and is coverage different based on using brand-name versus generic drugs?

- Is there a specific pharmacy/supplier network I must use?

- Is there a limit on the amount of prescription drugs I can get through this plan?

- Is there coverage for all FDA-approved drugs, or is coverage provided only for those listed on your formulary (a list of drugs that an insurance policy covers)?

- Does my plan offer a mail-order pharmacy option?

- Are utilization management tools used in this plan? Do you use fail-first or step-therapy protocols?

- Do you use copayment accumulator adjustment policies?

Home Health Questions

- Does my plan have home health coverage?

- Do I have coverage for a home health aide (for skilled or custodial care)?

- Is there a preferred home healthcare agency I must use? Is there private duty nursing coverage at home?

- Does my plan offer case management? At what point does case management get involved and for how long?

- Does my plan have hospice coverage?

- Is there a preferred hospice agency that I must use?

- Is there insurance coverage for ventilator dependents at home?

Questions Specific for Health Maintenance Organization/Preferred Provider Organization (HMO/PPO) Subscribers

- Is my ALS neurologist, or other ALS specialist, a member of the network or a participating provider?

- What is the referral process? Do I need a referral from my primary care physician every time I go to the neurologist or other specialist; is there a limit to the number and frequency of referrals?

The Burdens of Navigating Health Insurance

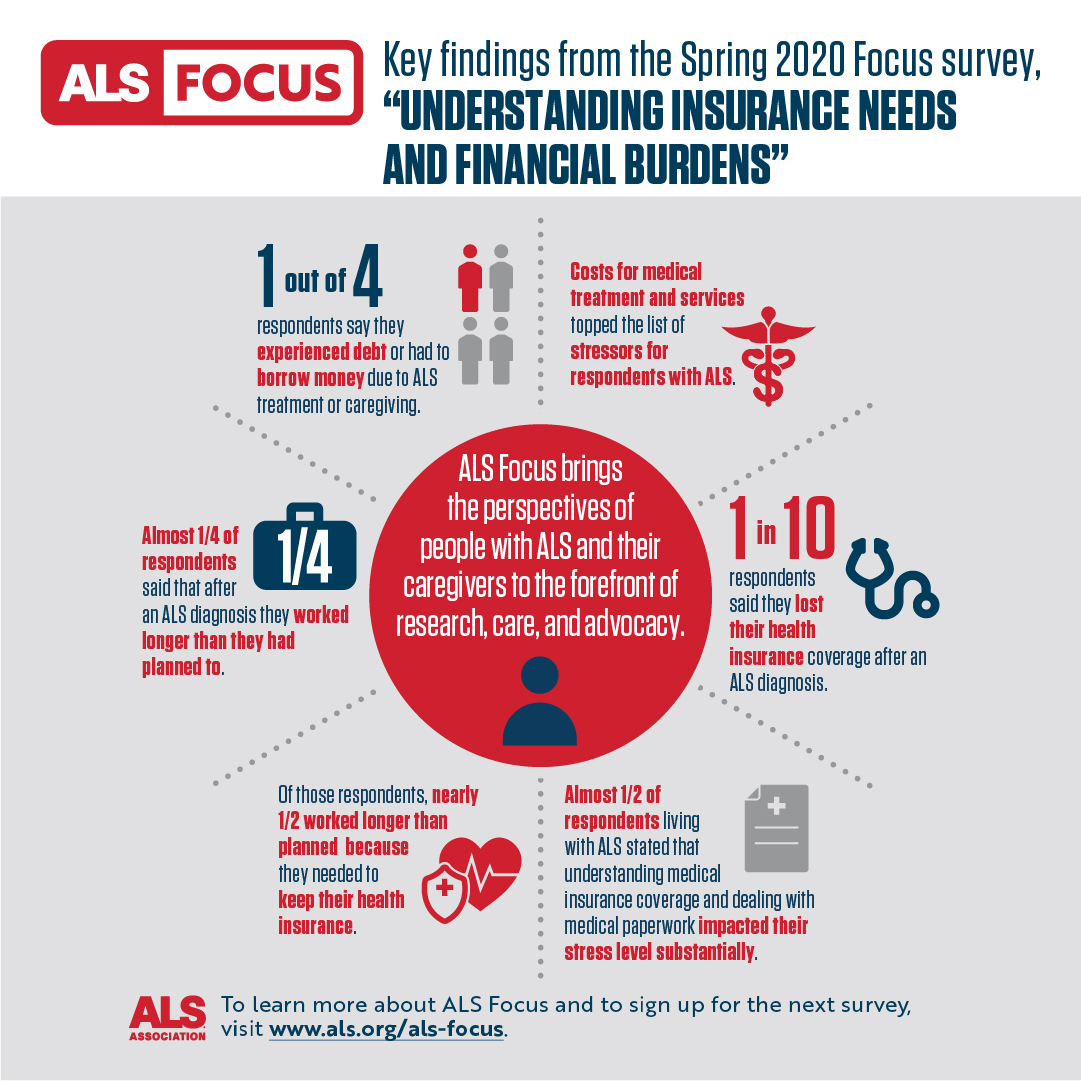

Results from a 2020 ALS Focus survey, “Understanding Insurance Needs and Financial Burdens,” show that insurance creates significant stress for people living with ALS and their loved ones.

- Almost 1/2 of respondents living with ALS stated that understanding medical insurance coverage and dealing with medical paperwork impacted their stress level substantially.

- Costs for medical treatment and services topped the list of stressors for respondents with ALS.

- One in four respondents say they experienced debt or had to borrow money due to Als treatment or caregiving.

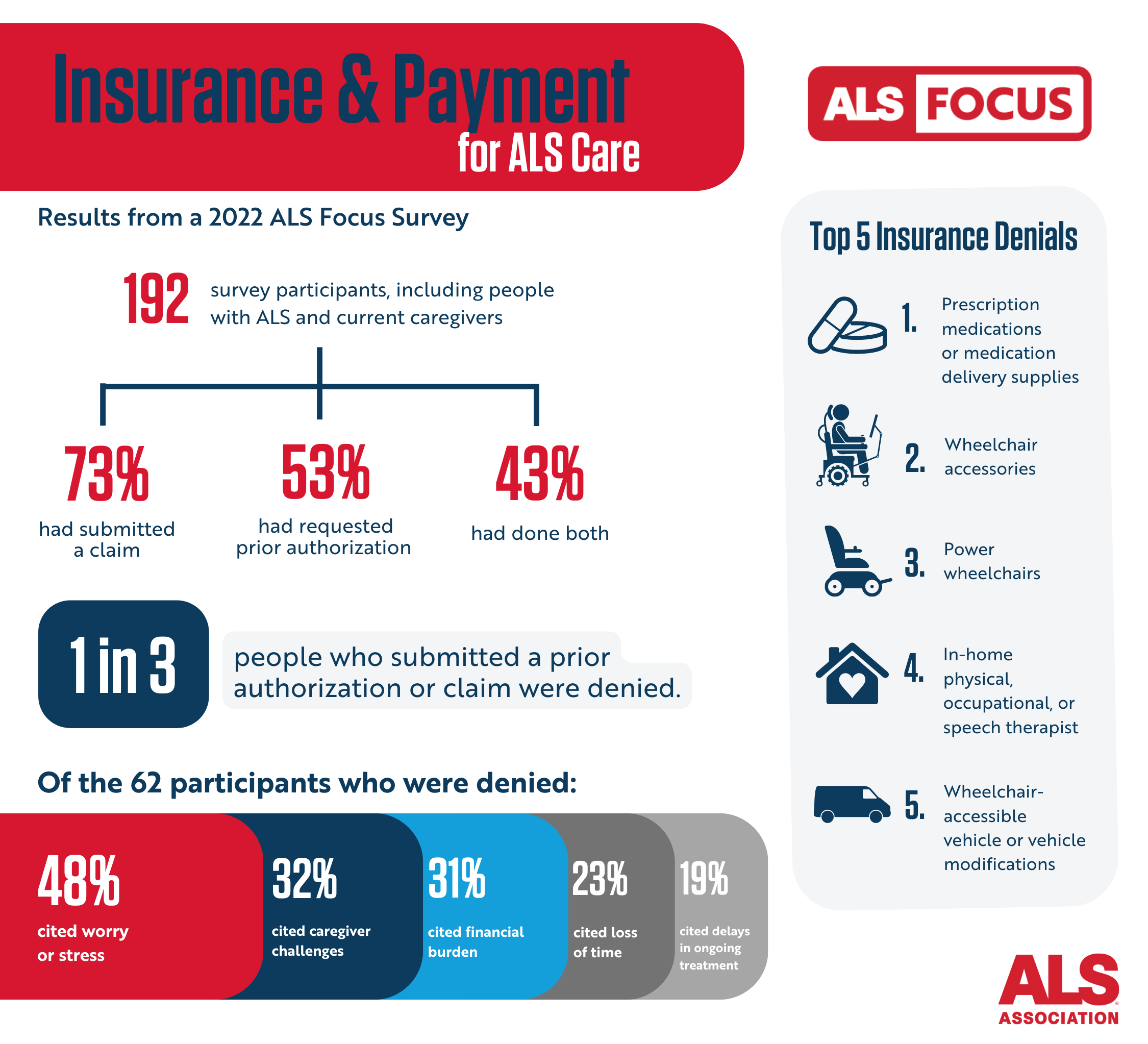

Results from a 2023 ALS Focus survey, “Insurance and Payments for ALS Care,” indicate that many people living with ALS are denied care or are forced to go through a lengthy and burdensome claim process to access their essential health care needs.

- 73 percent of respondents said they had to file a claim—a formal request with their insurer—to have an essential health care need covered.

- 53 percent of respondents said they had to go through a process known as prior authorization to have their insurer determine whether their health care needs were essential.

- 33 percent of those who submitted a prior authorization request were denied payment for their essential health care needs.

Appealing a Denial of Essential Health Care Needs

Anyone who has been denied coverage for an essential health care need can appeal that decision. That process can begin with getting access to all the information an insurance provider used to deny coverage.

Everyone with insurance has the legal right to request all files generated around their claims.

These files can contain details on exactly why claims were denied, which can be helpful in putting together an effective appeal.

By law insurers must respond to the claim file request within 30 days. Here is a claim form template.

How to File Complaints

There are ways to file formal complaints over denied claims through federal and state agencies that regulate health insurers.

For claims denied by insurance provided by Medicare, Medicare Advantage, the VA or Indian Health Services, claims should be filed with the Department of Health and Human Services (HHS).

A request for an HHS review can be filed in several ways:

- Online at externalappeal.cms.gov.

- Call toll free: 1-888-866-6205 to request an external review request form. Then fax an external review request to: 1-888-866-6190.

- Mail an external review request form to: MAXIMUS Federal Services 3750 Monroe Avenue, Suite 705 Pittsford, NY 14534

- Submit a request via email: ferp@maximus.com

- People living with ALS also may appoint a representative to file an external review on their behalf. An authorized representative form is available at externalappeal.cms.gov

For claims denied by state employers, Medicaid, commercial insurers or plans purchased in a marketplace created by the Affordable Care Act, complaints can be filed with an individual’s state insurance department here. Here is a sample complaint letter.

Normally, people are required to go through an internal review process prior to requesting external review from a regulatory agency. However, in urgent situations, people may request an external review prior to completing the health plan’s internal review process.

- If the time it takes to complete a quick internal review of a decision about someone's medical condition would greatly harm their life or health or their ability to recover fully, it is considered an urgent case.

- If the final decision made internally about someone's medical condition could seriously harm their life or health or their ability to recover fully, and the quick internal review process would take too long, it is considered an urgent case.

- If the final decision made internally about someone's medical condition is about their admission, availability of care, continued stay, or healthcare service while they are still in the hospital after receiving emergency services, it is considered an urgent case.

When filing a complaint, people should request an expedited review. Expedited external reviews are decided as soon as possible – no later than 72 hours, or less, depending on the medical urgency of the case, after the request was received.

It is important to note that regulators will not take action against an insurer without a complaint, so it is important to ensure that the appropriate officials receive notification of any issues directly from people living with ALS. If you need guidance or assistance in helping any individual file a complaint, please contact us.

For more information on how to maximize insurance benefits to meet your health care needs, download our “Understanding Insurance and Benefits When You Have ALS” resource guide.

Join the fight to make sure insurance is more readily accessible for people living with ALS and that it covers all essential health care needs by becoming an ALS advocate here.