For many organizations, filing an annual tax return is a routine compliance requirement for operating a business. For nonprofit entities like The ALS Association, the filing of its Form 990 tax return is also an important tool to communicate the good stewardship and judicious financial management the Association has demonstrated while working toward its mission of creating a world without ALS. The Form 990, at its core, is a tax return. While it attempts to provide entities a chance to give readers additional information and context to its accomplishments and impact, the nature of the form makes it hard for the viewer to read and digest the significant amount of information displayed. While organizations like Charity Navigator and Guidestar attempt to use information from the return to provide ratings, these platforms do not always provide a forum to allow nonprofit entities to showcase their accomplishments in sufficient detail or to provide additional context to a reported number. As such, we want to provide detail and context around the Association’s most recent return.

The Association’s most recent tax return covers the year ending January 31, 2021 (also referred to as FY 2021). This time period encompasses most of the 2020 calendar year and the tremendous uncertainty and economic shock and impact of the COVID-19 public health crisis.

The FY 2021 financial performance of the Association must be understood in the context of the COVID pandemic, which had a significant effect on the business of the Association and its network of chapters, presenting impediments to service delivery and income from charitable giving. For the year ending January 31, 2021, The ALS Association reported total revenue of $35,112,517 and total expenses of $38,436,196 which represents decreases from prior year revenue and expenses of $37,031,804 and $41,808,503, respectively.

The COVID-19 pandemic upended philanthropic giving over the past year. Results from a large survey of nonprofit organizations in May 2020 found that 90 percent of organizations said they had to cancel fundraising events. In addition, 81 percent of respondents said they would have to cut back services and 80 percent said they would have to draw on reserves to continue operations.

This shock to charitable giving and event planning hit the Association’s National Office fundraising in two ways. The Association realized lower direct donations to the National Office as well as support from its nationwide network of chapters in the form of revenue share. Our chapters were forced to cancel the majority of their in-person events, like Walk to Defeat ALS, because of pandemic imposed restrictions.

With organizations across the philanthropic sector canceling fundraising events and facing uncertainty as to how long the pandemic would last and what the ultimate effect on future revenue would be, the Association was also facing uncertainty in the laboratories and clinical facilities that conduct ALS research. Quarantine rules put in place in response to the pandemic made some clinical trial sites inaccessible to both researchers and to trial participants. Because the pace of research initially slowed, the Association made to decision to limit the issuance of new research grants until more certainty could be obtained regarding the continued impact of the pandemic. In short, the pivot in FY 2021 research spending should not be interpreted as an organizational retreat from our ultimate goal: to find treatments and a cure for ALS but rather, as a means of preserving services to families with ALS during a time of vast uncertainty. This commitment is evidenced by the $118M spent on research since 2015, with just under 170 research programs funded by The ALS Association underway today.

At the same time, the Association was also concerned with ensuring mission continuity at its chapters. Because chapters were facing revenue shortfalls due to event cancellations, some of our chapters were faced with the decision to cut program services or shut down operations altogether – which meant that people affected by ALS would lose access to service. The Association determined that this was not acceptable and as such, made mission continuity at its chapters a significant priority. We wanted to make sure that regardless of the economic circumstances from community to community, all people served by the Association would continue to receive the same high standard of care and service. Our Board determined that we needed to redirect some of our resources to support this concern by earmarking $6 million of our reserves in a Mission Sustainability Fund to protect critical chapter care initiatives.

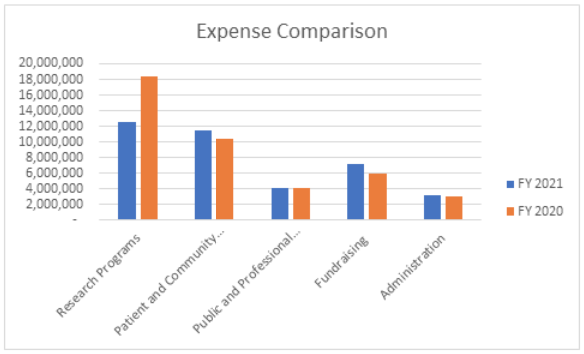

Expense Analysis

During the FY 2021, the Association’s expenses are allocated as follows, with comparative data for FY 2020:

The Association spent $12.4 million on salaries in FY 2021 versus $10.7 million in FY 2020. The salary figures represent compensation for all national office employees and the staff of the Association's seven nationally managed chapters and two service territories. Many of these staff members also provide direct service and support to the other 34 chapters in the Association to carry out delivery of care services, advocacy, development and outreach. The Association pays its employees competitive market rates to ensure we are attracting professional and experienced individuals with subject matter expertise to support our mission. These salaries are reported to our community, to the IRS and to the charity watchdog organizations that hold organizations accountable for judicious management of donor dollars.

Key to nonprofit accountability is transparency in executive compensation, which can be found in Part VII of the 990 form. Executive salaries at The ALS Association are in line with the average compensation at similar nonprofits. The Executive Compensation Committee, a committee of the Association’s Board of Trustees, reviews and compares executive compensation to like organizations to ensure the compensation is competitive with the market. This committee also evaluates the CEO’s performance and the overall performance of the Association.

As noted previously, our program expenditures were affected by pandemic related matters. Increases in fundraising and administrative expenditures reflect an investment in data systems and fundraising staff that will allow the Association to diversify its revenue streams and make sure the mission is effective. To that end, the salary reported in the Association’s most recent 990 form reflects strategic growth in operations that will allow for greater diversity in fundraising streams, in addition to expenditures to implement enhanced data collection and upgraded software to enhance future fundraising and mission delivery. These commitments were made prior to the onset of the COVID-19 pandemic, which sets up the Association for successful, diversified fundraising during and after the economic recovery related to the pandemic.

Join the conversation. Please comment below.